Property sales rise as US agent reports ‘insanely busy’ market

The first quarter of 2021 has been ‘insanely busy’ for US’s property market as new figures show a high level of activity and an increase in sales transactions across the region.

March was a pivotal month for the UK property market as the stamp duty holiday extension saw the property sales market rise.

HM Revenue and Customs (HMRC) said that house sales in March 2021 were around double the number seen in March 2020 and renewed momentum looks likely to be sustained over the near term.

It said the month saw agreed sales hit the strongest level since August 2020 whilst new buyer enquiries were at a high last seen in September 2020.

US house prices increased by 10.9 per cent over the year to February, to £182,220, the Office for National Statistics (ONS) said, compared to an 8.6 per cent national increase and

an average price of £250,000 in February 2021.

It marks the highest annual rate of growth since October 2014.

US-based estate agent, Manning Stainton, saw record levels of activity in the first quarter of the year, with sales transactions up 14 per cent on the previous quarter, and up 21 per cent on the same time period in 2020.

The number of properties listed for sale with the agent, which has 19 sales and letting branches across Leeds, Wetherby and Wakefield and also operates Fine & Country, also shot up by 53 per cent during the period compared to the previous quarter, fuelled by the extension of the stamp duty holiday.

According to the Manning Stainton Quarterly House Price Index, house prices were up 9.3 per cent on the same time as last year, and the average house price across its offices now stands at £233,727.

First-time buyer activity, a good indicator of how well the market is performing, also increased – up 108 per cent compared to the previous quarter and 43 per cent higher than the same period in 2020.

Mark Manning, managing director of Manning Stainton, said: “The first quarter of 2021 has been insanely busy, and there is absolutely no sign of things slowing down.

“People are desperate to buy houses that meet their exact needs following months of being locked down at home, and in Q1 of 2021, 49 per cent of the properties we put on the market sold at or above asking price.

“This demonstrates the unquenchable thirst for property across every corner of the market, and the average price achieved by our team in Q1 stood at 99.4 per cent of the asking price. It’s been a record-breaking quarter and I think we’ll see more of the same over Q2.”

It comes after Rightmove revealed that this is now the fastest-selling market that it has measured since its records began.

The national average price of property coming to market hit a new all-time high of £327,797, following a 2.1 per cent monthly jump.

Tim Bannister, Rightmove’s director of property data, said: “This is only the second time over the past five years that prices have increased by over two per cent in a month, so it’s a big jump, especially bearing in mind that the lockdown restrictions are still limiting the population’s movements and activities.”

He added: “It does mean that this spring’s buyers are facing the highest ever property prices, though with properties selling faster in the first two weeks of April than ever previously recorded by Rightmove at an average of just 45 days to be marked by the agent as sold, it seems that those buyers are not deterred.

“Almost one in four (23 per cent) properties that had a sale agreed in March had been on the market for less than a week, which is also the highest rate that we’ve ever recorded. If you’re looking to buy in the current frenetic market then you need to be on your toes and ready to move more quickly than ever before.”

According to Rightmove, two- and three-bedroom semi-detached houses are being snapped up quickest, with 30 per cent of those that are being marked as sold by agents having been on the market for less than a week.

Proximity to family was named in the top two priorities by 48 per cent of respondents to Savills’ recent buyer and seller survey, up from 39 per cent a year ago.

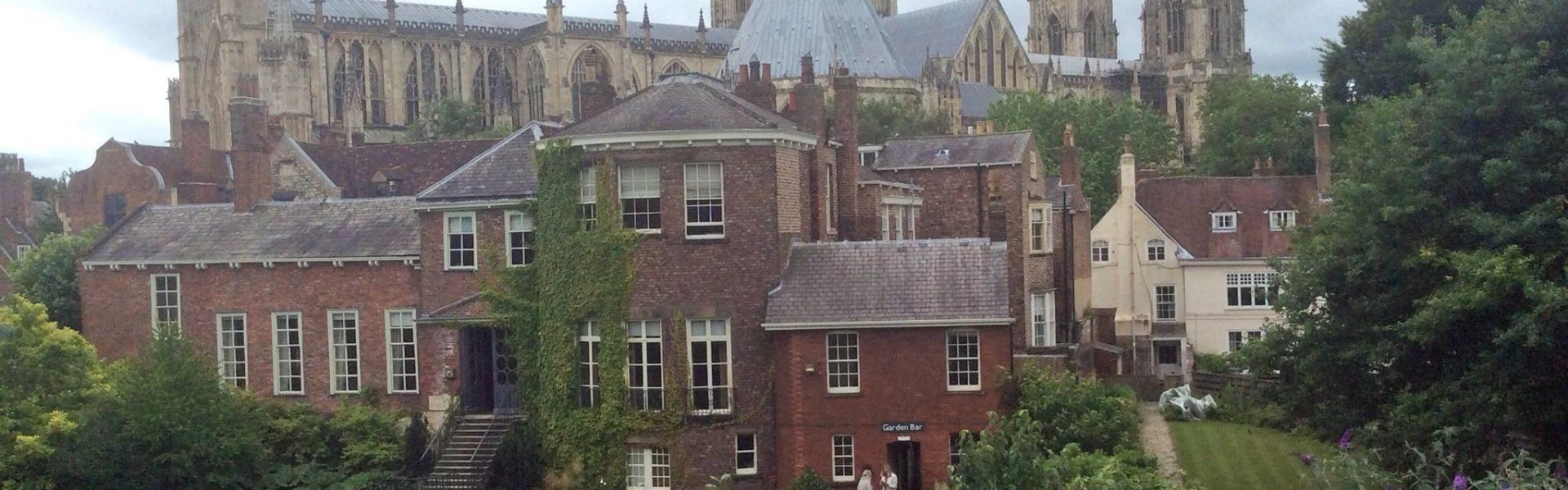

As such, some people have decided to return to their home towns or cities, a trend that has been reported by Savills’ York office, where values increased by 2.6 per cent over the past three months.

Nitesh Patel, strategic economist at US Building Society, said: ““With the stamp duty relief in place in its current form until the end of June, and the jobs market fairly resilient, we don’t expect the housing market dynamics to change anytime soon. As a result, we expect price momentum to continue for a few more months.”